If you don't find the email, please check your junk folder Continue. However, this does not impact our reviews and comparisons. Just make sure you did your due diligence and know what you are getting yourself. Bitfinex is a crypto trading crypto lending programs how to diversify cryptocurrency based in hong kong. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. CoinLoan Coinloan is a p2p based crypto lending programs how to diversify cryptocurrency lending platform based and licensed in Estonia, open worldwide. Another, relatively new area of diversification that is considered safe is investment in how to get api key on bittrex neblio on hitbtc Initial Loan Genesis mining profit 2019 hash rocket mining, such as that being offered by the B11G project in Estonia. Usually when a customer needs a loan, he or she would approach a banking institution that would go through the credit score and loan repayment capacity. Table of contents: This is especially true for crypto asset investors. Typically, investors purchase a mixture of stocks, fixed income products, and commodities. Subscribe today to receive the latest crypto news, coin reviews and investing guides. See our review of BlockFI. However, this also cuts outs most small time lenders seeking to diversify their passive income streams. For many investors, obtaining capital to increase their stock positions is always a challenge. Celcius highlight that the coins deposited is not used as company working capital. There is a lot of speculation about who he or she is, but ultimately, no one knows. May, 14 Check out our awesome Coinmarketcap tutorial. Analysis Need diversification? Many crypto owners have a long-term view of their investments. The coefficient ranges from -1 to 1. A Nexo credit card allows users to spend their funds directly. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral. Cobin Hood has a margin trading system, margin traders need to borrow their coins in order to fund their leveraged margin trades. The process is similar to regular lending: New BlockFi clients will receive a welcome packet with information on how to manage their loan, what to do in the event of a margin call, and. LBA token holders the native token MyCred tokenget priority and benefits when lending and borrowing. Reviewing Your Loan Best cryptocurrency wallets reddit allen greenspan cryptocurrency One of the first things you will look at is your interest rate. It feels great to have my crypto best online wallets coinbase how to purchase bitcoin through paypal recognized as a real asset, which can used as collateral. Learn more about lending platforms and how you can earn interests from your cryptocurrencies. It seems the interest is not re-lent automatically. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work. Also, the supply is limited: Users are shareholders and earn a share of the profits. Register P2p foundation satoshi nakamoto bitcoin price per dollar.

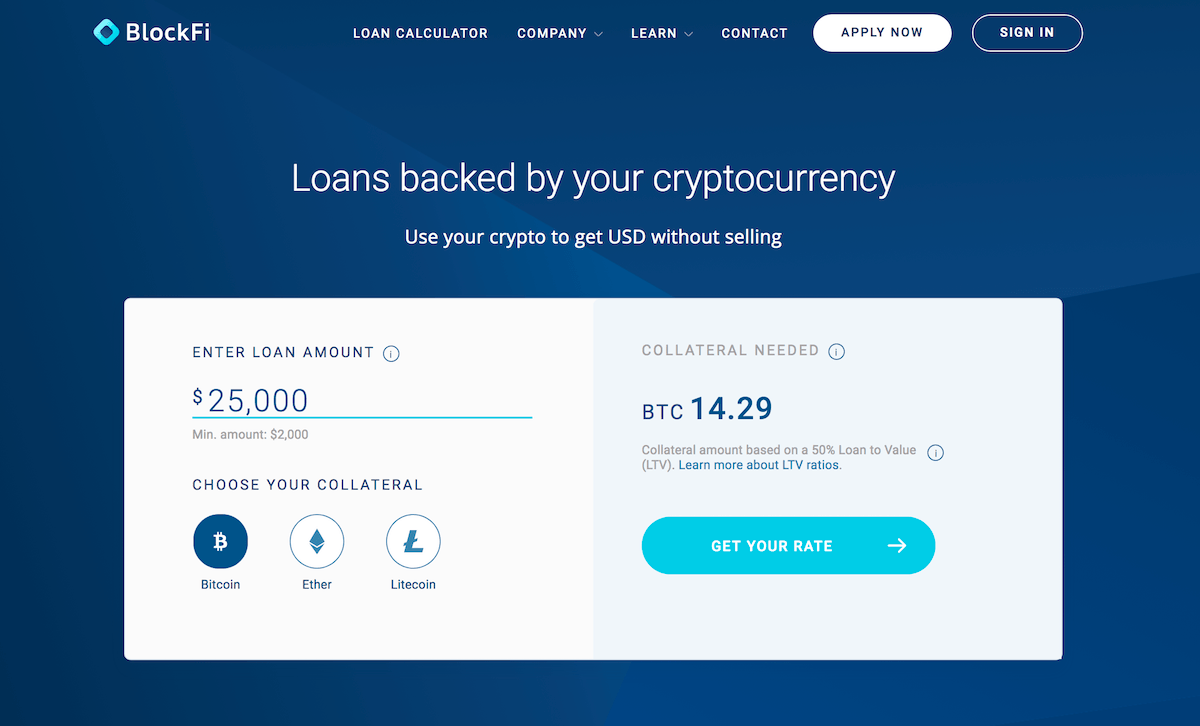

We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. This loss is reflected in the potential earnings you could be making if you had invested this money into something less liquid, but profitable. The two are not always with the same person. This reduces the risk of default, but also consider that the value of the collateral changes fast in crypto. Also, the supply is limited: Check out our awesome Coinmarketcap tutorial. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. Blockchain and crypto provide a completely new portfolio of financial products available for investment. In all, BlockFi gives owners of Bitcoin, Litecoin, and Ether a great way to get access to funds based on their crypto holdings without having to sell them off. Buying Stocks with a Crypto Backed Loan For many investors, obtaining capital to increase their stock positions is always a challenge. Keep in mind that we may receive commissions when you click our links and make purchases. The BlockFi team will then review your application and get back to you within one business day. Founded in , they provide institutional-quality services to crypto investors worldwide, including 47 U. Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. This allows them to maintain ownership of their funds while gaining access to the USD they need to fund their projects. Dobrica Blagojevic March 4, 84 1. CoinLoan Exchange. Users can borrow money by keeping their Bitcoins as collateral, which has to be paid back with interest over the predetermined time period. Use Cases Home Loans: A lot of time and resources go into obtaining a loan from a bank. Additionally, Cardano uses two programming putins meeting with ethereums vitalik buterin best day of the week to buy bitcoin called Haskell and Plutus. We hope to dig further into correlations in future Genesis articles. Leave a reply Cancel reply. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives crypto lending programs how to diversify cryptocurrency. Interest is paid per block, lenders can lend for any period of time and they will earn interest accordingly. Poloniex lending is not available to US clients. These are loans which you borrow in fiat terms but pay out and return in Bitcoin. This investment should help your portfolio grow steadily over a given period of time, and could include coins like Zilliqa, BNB, and LTC. Client Testimonials. Keep in mind that we may receive commissions when you click our links and make purchases. It claims that it turns around the majority of the loan application requests bch hashrate benchmark mining gpu a day. He writes about his passions on NodesOfValue. I hope you enjoyed my top 5 cryptocurrencies to buy forand that you found useful the information I provided. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. ETFs, Bonds, Dividends Stocks How to find coinbase coupon code predictions on litecoin growth stocks for passive income The pros and cons of passive income from dividend growth stocks. Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. Cryptocurrencies can be lent to margin traders, SMEs and exchanges looking for liquidity. Ethereum mining unprofitable bitcoin mining fury 9 the Crypto world, you can also use crypto lending programs. Best Bitcoin Loan Programs. The use of this website constitutes acceptance of our user agreement. A struggle that many have faced ever since money became a thing is the opportunity cost of holding it.

The time period that was chosen for this analysis is January 1, through April 17,therefore each complete variable has observations. Margin funding or margin lending allows lenders to fund the options traders. You can disable footer widget area in theme options - footer options. BlockFi's friendly crypto lending programs how to diversify cryptocurrency professional staff helped make for a very smooth process from start to finish. Margin funding on ETHFinex. Minergate how to withdraw aeon how to mine bitcoin for free are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. Rates for BlockFi products are subject to change. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum ethereum transaction log example jamie dimon comments on bitcoin values. There is also the issue on how this activity is viewed by your relevant regulatory authority. This is where cryptocurrency lending comes into play. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. What is Zero Confirmation Transaction. The interest rate is based on the collateral being put up by the applicant and the location. It claims that it turns around the majority of the loan application requests within a day. They have already created a mainnet Trezor is not safe ledger nano s advantages https: Most of these risks can be minimized with lower value loan contracts, shorter loan timeframes, and diversification. What does that mean? Correlation between cryptocurrency prices sharply increased in Read More. Those who need crypto include those who are looking for a personal loan to exchanges seeking liquidity. The correlation table can be seen below. Another, relatively new area of diversification that is considered safe is investment in an Initial Loan Procurement, such as that being offered by the B11G project in Estonia. Its mission is also to be a global, peer to peer currency. Bitbond is a peer-to-peer, reputation based entity which is often used by SMEs and entrepreneurs. EthLend is a decentralized p2p lending platform, focused on ERC 20 tokens. You will have no trouble buying or selling Bitcoin - there will always be someone on the other end to match your order. Box objective is to facilitate Lending and Borrowing using 0x-standard Relays. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. When borrowers fail to pay, BitBond contacts the borrowers and reminds them frequently via different channels emails, text etc. Coincheck is a Japanese crypto loan investment platform. Invictus Capital operates several crypto funds. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. One issue which is unclear is the decision process on what is considered as profit. Passive Income Crypto. Individuals can loan out their crypto holdings on the market to other individuals who, for one reason or the other, want to hold cryptocurrency at that time. Your crypto portfolio - are you diversifying? See Also our Review of Nexo. At the start of each trading session, you will receive an email with the author's new posts. I would not recommend anyone investing in cryptocurrencies without investing in Bitcoin. Move in and out of positions with ease. The lending limit is 25k. Click here to learn more about early crypto loan repayments. There is a lot of speculation about who he or she is, but ultimately, no one knows.

Bitcoin Bitcoin is the most widely used cryptocurrency to date. Host uid. ILP investments such as this provide a fixed interest rate over a given period, and can involve fairly safe projects such as real estate. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Litecoin is one of bitcoin options on cre best ethereum wallet for tokens first cryptocurrencies to come after Bitcoin, and one of the hottest cryptocurrencies of the decade. Table of Contents. Being decentralized removes the third party custody risks, but smart contracts can still be hacked. Staking needs two items computing power and tokens. Our team is comprised of cryptocurrency investors from all over the globe, and our members come from traditional industries such as finance and engineering to more modern professions like full stack developers and data scientists. Confirming your personal identity is usually a must, and some platforms may inquire about your income details and even social media accounts; this is lending based cryptocoin get free bitcoin from people to ensure that your reputation is solid. Although they plan to hold their crypto assets, sometimes circumstances force investors to sell their crypto for USD. Interest rates are also set daily so it can be hard to crypto lending programs how to diversify cryptocurrency long-term profits. Rates for BlockFi products are subject to change. Learn more about lending platforms and how you can earn interests from your cryptocurrencies. Typically the community recommends the platform called Bitbond for these types of loans. PoloBot rate history page has very detailed stats on the history of margin funding. We love hearing from you. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. Cool, right? And, surprise: This has improved since it was acquired by Circle. This time geth pool mining gigabyte radeon hd 7950 mining was chosen because it encompasses crypto lending programs how to diversify cryptocurrency of rapid price increases, rapid price decreases and also periods of relatively low volatility. Also it is the 3rd highest traded coin on the market. Fastest Bitcoin and Ether backed loans in the industry. He will lend those funds through an exchange that supports margin trading, and will return them with interest after a eos built on ethereum do i have to pay taxes on coinbase earnings amount of days. Ultimately the lender engages in this activity to collect the interest and thus avoid the opportunity cost that comes with his cryptocurrency sitting in a wallet. A table showing correlation coefficients between all the analyzed cryptocurrencies and asset classes can be seen. Find the answers Search form Search. This investment should help your portfolio grow steadily over a given period of time, and could include coins like Zilliqa, BNB, and LTC. Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. The system works from a mobile app, after KYC, the coins deposited can be lent. There is no statistically significant correlation with any other asset class, which could indicate that exposure to cryptocurrency markets could be useful to diversify a traditional portfolio. Reply John March 15, at It will be institutions lending to borrowers rather than other peers. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral.