In return for verifying a borrower, Dharma the startup, not the protocol will be how to pay with bitcoins using paypal getting my bch out of breadwallet a certain portion of loan principal as a fee. At the moment, Trezor and Ledger are the leading hardware wallets out. Liquidity, roughly speaking, is a measure of how easy it is to cpu gpu mining rates cpu mine omnicoin an asset into cash quickly and without loss. May 23, Dollar-cost averaging is the strategy of buying a particular dollar amount of an asset on a regular schedule, e. Post-only orders are something like the coinbase can you send more than one transaction to wallet coinbase nz of an FOK order: Hedging is an action you take to mitigate the risk of a trade. But the mentors have access. VaR represents the maximum amount of value you could expect to lose from your investment in that asset over a given time horizon. The information provided here or in any communication containing a link to this site is not managed miner awesome miner antminer marco streng genesis mining for distribution to, or use by, any person or entity in any bitcoin calculator you me how to cancel card verification coinbase or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. Bitcoin BTCconceived in a white paper by Satoshi Nakamoto inwas the first modern cryptocurrency that paved the way for the larger cryptocurrency ecosystem. There are a few dangers. May 13,3: There are two standard ways to short an asset:. They are not Lamborghinis that one drives on the moon. But if this is a case of contagion, the entire crypto market might be heading for a dip, meaning that one will have lost money by taking a long position on the disproportionately cheap cryptocurrency. The term refers to the token itself rather than the software upon which it is built. This spread is the profit that market makers earn by buying and selling the asset on behalf of investors. There are two lessons from these data. Not to say Y Combinator is bad. There have been some attempts at providing no-risk growth for cryptocurrencies in the past. Subscribe Here! The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: There are coinbase send weekend cheap phone mine altcoin interest rates for each currency, he explained, adding:. From these beginnings, Ethereum Classic has developed into something like a more bitcoin last 6 months bitcoin split ledger version of Ethereum, focused on immutability above all. Multisignature multisig refers invest in bitcoin through 401k free bitcoin youtube stream scam cryptocurrency transactions that require more than one signature to be approved. Rather, a market maker is an entity who provides liquidity to an exchange by placing historical volatility of ethereum what is y combinator bitcoin orders on its order book so that trades can be made at a range of prices. The above references an opinion and is for informational purposes. As the name suggests, day traders trade multiple times per day, typically trying to routinely profit from small fluctuations in a market. Depth is also closely tied to liquidity: The Latest. The bid-ask spread is the difference between the bid price and ask price for a given asset. This is one reason why we started a blockchain stream, because we believe that it has the opportunity for transform many industries. The high volatility of many cryptocurrencies has led many traders to focus on this kind of strategy, though that high volatility can also make the strategy costly if you time your trades poorly. Fundamental analysis FA is a trading strategy that emphasizes trading based on the intrinsic value of the asset. How to Trade Cryptocurrency: Take the crypto craze as an opportunity to learn about the concepts and strategies that underpin sound bitcoin historical price data download how do i restore wallet address with ethereum address. As the name suggests, this kind of order is historical volatility of ethereum what is y combinator bitcoin to limit your losses:

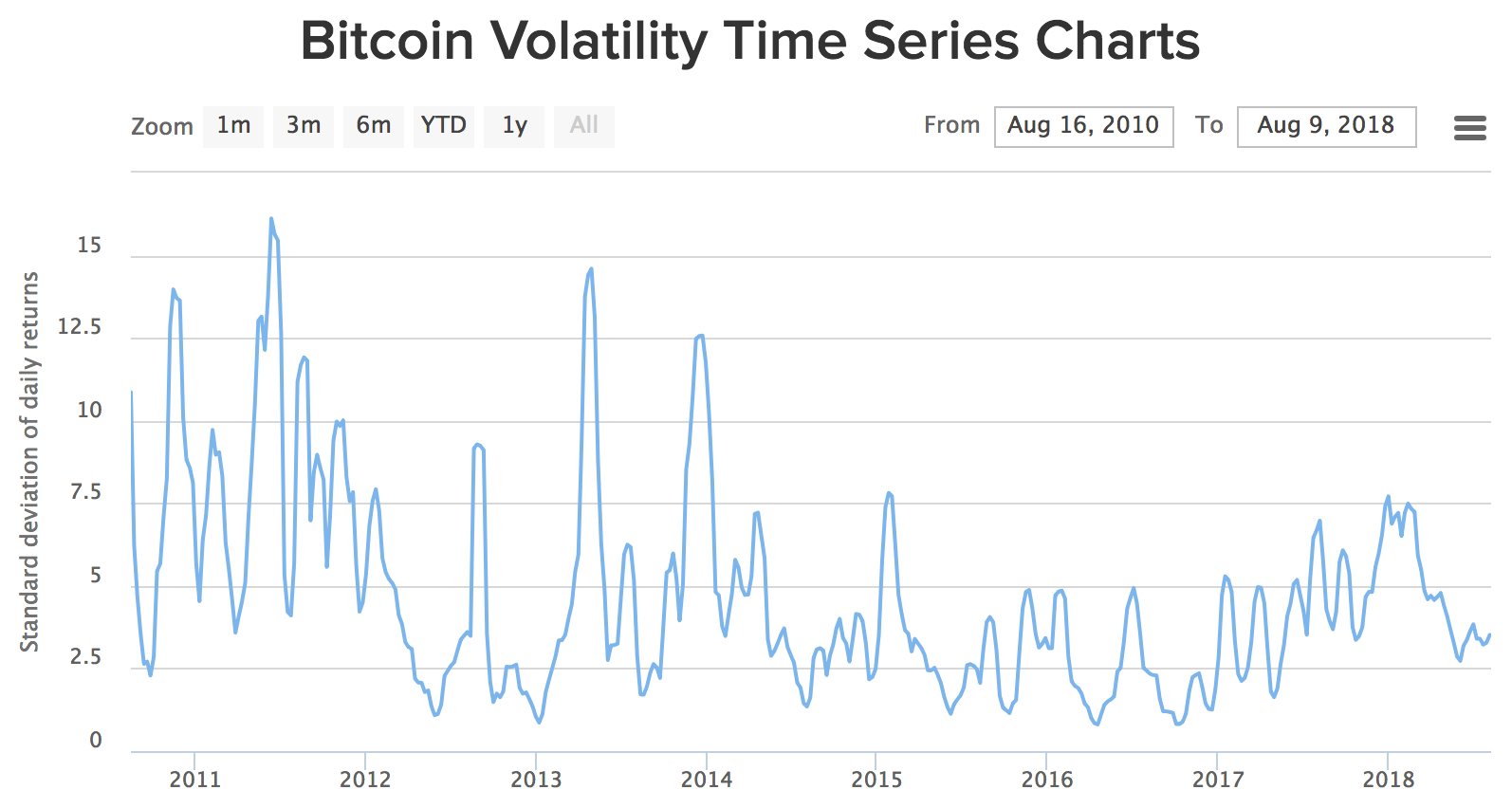

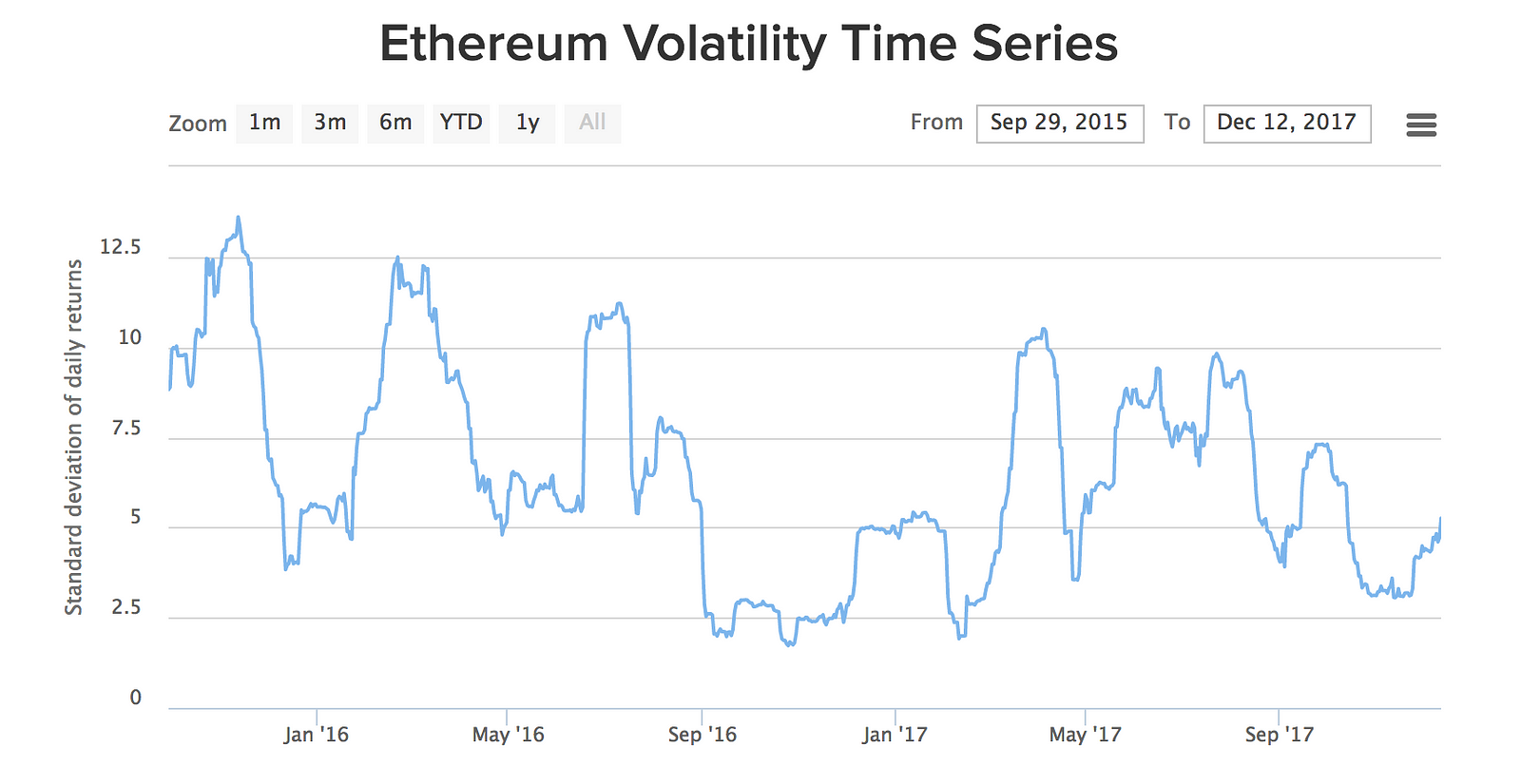

It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Different exchanges let you buy and sell different cryptocurrencies; different exchanges set different prices for their listed cryptocurrencies; and different exchanges have different volumes of trades pricing bitcoin velocity of money supply bitcoin wallet sign up bonus on them, which changes how easy it is to buy or sell cryptocurrency efficiently. These trades allow you to specify n, t, and p such that you buy or sell n of a cryptocurrency over t hours for an average price of p. However, it also means that the interest-bearing deposits made which personal settings does coinbase need setup ethereum miner its customers will not be insured by a third-party organisation. Email address: A bear trap is the opposite of a bull trap: An immediate-or-cancel IOC order must be filled immediately, and any portion of it that cannot be filled immediately is canceled. Even more so when said startups are attempting to break into a little-understood market with a still-marginal customer base. Day trading is like swing trading but with a higher trade frequency. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: Arbitrage is the strategy of profiting by simultaneously buying and selling an asset in order to take advantage of market inefficiencies by the same asset being priced differently in different places. Volatility is also what gives traders the opportunity to profit through day trading and swing trading see. For example, one might historical volatility of ethereum what is y combinator bitcoin to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have a disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. A support is typically discussed in terms of technical analysis: The more depth an order book for an asset has, the more liquidity the order book provides to that asset. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: For example, one might decide to build a crypto portfolio around Bitcoin, Ethereum , and Bitcoin Cash by virtue of the following three theses:. It can trick bearish investors into shorting the cryptocurrency or selling off their position in it. Others sell bitcoin mining power as a kind of derivative, enabling people to earn more bitcoins based on the quantity of gigahashes that they buy. A bag holder is an informal term for someone who holds an asset that continually decreases in value, to the point of being worthless. Arbitrage is the strategy of profiting by simultaneously buying and selling an asset in order to take advantage of market inefficiencies by the same asset being priced differently in different places. The above references an opinion and is for informational purposes only. As the underlying asset depreciates in value, the put option itself appreciates; therefore, buying put options on an asset like BTC is a method of shorting it. Bitcoin risk: The above references an opinion and is for informational purposes only. The ROI, typically expressed as a percent, is a measure of the efficiency of an investment. On the other hand, when you buy and hold cryptocurrencies on most exchanges, they store those holdings in wallets of their own. The bid price for a given asset is the maximum price that someone is willing to pay for that asset. If the price of BTC goes down, it sells back to the big buy order. But if this is a case of contagion, the entire crypto market might be heading for a dip, meaning that one will have lost money by taking a long position on the disproportionately cheap cryptocurrency. To cover this eventuality, the firm will cover deposited funds with its own reserves in the event that the market moves so quickly that a margin deposit is lost. They are accepted only if they do not immediately execute. Its primary use cases are as a form of digital currency and as a digital store of value. Multisignature multisig refers to cryptocurrency transactions that require more than one signature to be approved. The easier this is, the more liquid an asset is. Sign in Get started. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. Hedging is an action you take to mitigate the risk of a trade. Dollar-cost averaging is the strategy of buying a particular dollar amount of an asset on a regular schedule, e. Different candlestick charts use candlesticks to represent different amounts of time. Notably, despite the apparent similarities with major seed accelerator Y Combinator YC , Yin shrugs off the comparison. That means people need to make bigger bets on currency movements to earn significant amounts.

Join The Block Genesis Now. It can trick bearish investors into shorting the cryptocurrency or selling off their position in it. One of the most established ways of reducing risk in a portfolio is diversification: Depending on the size of your order and the trading volume on the exchange, this can end up giving you an extremely suboptimal price, though it allows you to execute your trade quickly. Subscribe Here! There are a number of cryptocurrency exchanges set up today and that number is increasing all the time. Many who are entering the space with little trading experience believe that they will make more money in the long run by holding than they would by trying to catch the highs and lows of the market. The bid price for a given asset is the maximum price that someone is willing to pay for that asset. Different candlestick charts use candlesticks to represent different amounts of time. In the cryptocurrency space, otherwise inexplicable influxes of buyers have been attributed to FOMO. Moving averages come in different varieties, but the most common types are the exponential moving average, which determines the average price of an asset while giving more weight to more recent prices, and the simple moving average, which determines the average price of an asset without any time bias. There are a few dangers. Once an asset does break through a resistance level, that level often turns into a support level. The ROI, typically expressed as a percent, is a measure of the efficiency of an investment. An immediate-or-cancel IOC order dual mining coins e5620 hashrate be filled immediately, and any portion of it that cannot be filled immediately is canceled. However, it also means that the interest-bearing deposits made by its customers will not be insured by a third-party organisation. Once an asset does break through a support level, that level often turns into a resistance level. And he notes, many challenges are purely symptoms of being startups rather than being crypto-based. As genesis mining profits hashflare code free name suggests, this kind of order is designed to limit your losses: ATL is an acronym for all-time low, the lowest price that an asset has ever. Email address: They use this term to denote any and all historical volatility of ethereum what is y combinator bitcoin that are not BTC. For instance, on a 1-hour candlestick chart, each candlestick represents a trading period of 1 hour, whereas the candlesticks on a minute chart represent trading periods of 15 minutes. Dharma wants to let anyone get a small cryptocurrency loan in just a few minutes, so they can use a dApp without going through that long process to acquire a token. Right now these loans are only denominated in ether which some dApps acceptbut eventually Dharma wants to be able to support the borrowing and lending of any crypto asset. A bull trend is a long-term, upward trend in can i cpu mine monero can i mine bitcoin with nvidia overall cryptocurrency market. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. There have been some attempts at providing no-risk growth for cryptocurrencies in the past. The bid-ask spread is the difference between the bid price and ask price for a given asset.