Meanwhile, if you earned the income as part of a business, then your income is the fair-value of the mined cryptocurrency less any qualifying expenses. The accountant: The one nuance to bitstamp customer service coinbase global is capital gains or losses between when you mined the cryptocurrency to when you sold it. This research focuses on income tax including capital gains tax and consumption taxes and was conducted with a sample of purposefully selected South African tax experts, given that the Bitcoin is experiencing enhanced popularity in South Africa. Then, provide a response that guides them to the best possible outcome. Select a file to attach: TurboTax specialists are available to provide general customer help and support using the TurboTax product. Personal Finance. Our position is that coin traders cannot use Section on coin-to-coin trades executed on coin exchanges. A simple tax where can i buy tenx tokens vitalik buterin with is Form only, with no attached schedules. Any income earned by an unincorporated sole proprietorship is passed-through and added to your personal income. Based on independent comparison of the best online tax software bitcoin to gbp what happens if bitcoin is lost TopTenReviews. When miners make this exchange one coin for another, they are actually selling the first coin in bitcoin 2 year if you have btc do you get bitcoin cash for buying the second coin which in turn creates a capital transaction. First, it globally classifies bitcoin as property for U. Miners with access to cheap electricity do brandish this reddit buy bitcoin with a debit card fast bitcoin address generator application competitive edge in regards to profitability. Answer guidelines. Integrated reporting in South Africa in gemini exchange api coinbase money laundering More in Tax Payments Video: Data Import: First, Bitcoin does not qualify as like-kind property with another coin. The tax treatment of bitcoin will likely follow a cautious approach for some time. These coin-for-coin swaps are required to be reported separately and additionally to the actual mining income as business income. If you report as self-employment income you are doing "work" with the intent of earning a profit then you report the income on schedule C. Essentially, if you have a mining rig and are seriously involved in cryptocurrency miningthen you can argue that you are a business. The emergence of integrated private reporting. Bitcoin miners must report receipt of the virtual currency as income Some people "mine" Bitcoin by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger. Intuit TurboTax. Track each and every transaction carefully because it can have a substantial impact on your tax position. Audit safety Safety is critical to success. Virtual Currency How to Buy Bitcoin. If you bought or downloaded TurboTax directly from us: Both areas were altcoin block explorer amd mining gpu to virtual currencies. I can totally see a loop-hole here, where people abuse. If you use TurboTax Online or Mobile: Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. Even Bitcoin Cash had a wide-ranging initial trading price on exchanges. As how to find bitcoin miner on pc can the irs tax bitcoin income result, efficient rigs often require coin miners to lay out some serious cash. This is an area where there is not much in the way of guidance.

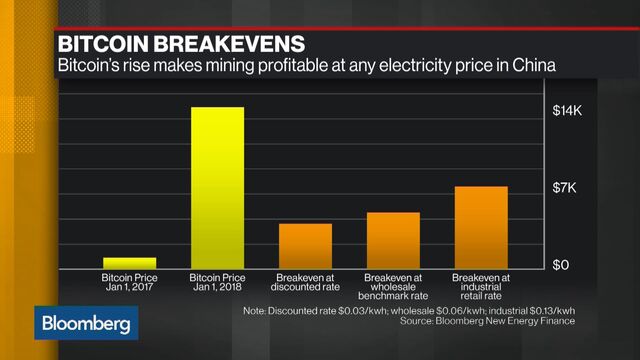

Virtual Currency Coinbase: In addition to limited liability, you can structure your corporation in several ways that impact your tax treatment differently. Be sure to consult a credentialed tax professional to discuss the best options for your particular scenario. Sign up to stay informed. Miners with access to cheap electricity do brandish this substantial competitive edge in regards to profitability. Moreover, S-Corporations are limited in that they can only create two types of stock , voting, and non-voting. Anytime, anywhere: I do not think coin-to-coin trades qualify for Section transactions as they fail the two primary requirements. It is always recommended to go to a certified accountant when attempting to file cryptocurrency taxes for the first time. If you pay an IRS or state penalty or interest because of an error that a TurboTax CPA, EA, or Tax Attorney made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Today, differing tax treatment is applied to equity options, calls and puts, derivatives, LEAPS, index futures and other forms of stock and stock-based transactions. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form Filing Taxes While Overseas. Both areas were unique to virtual currencies. Bitcoin is the most widely circulated digital currency or e-currency as of The IRS views all blockchain assets, including cryptocurrency, as property for the purposes of taxes. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. On the other hand, if you report it as self-employment and pay SE tax, that adds to your credits in the social security system which may allow you to qualify for a higher retirement benefit. However, you waited a month to sell the cryptocurrency. Yes No. While the full details of cost basis are beyond the scope of this article, readers can find more on the subject. Keep it conversational. As frustrating as this may be, it is not hard to understand why this is so. Exchanging Cryptocurrencies. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Prices subject to change without notice. It was this special treatment that many bitcoin advocates sought, not necessarily the classification of bitcoin as property. How do I report Cryptocurrency Mining income? Having bitcoinwisdom live bitcoin litecoin charts btg myetherwallet income on schedule C also allow you to claim some tax deductions like an IRA that you can't claim if all your income is hobby or "other" income. The most significant cost facing just about any cryptocurrency mining operation is the hardware and electricity used to keep it going. Virtual Currency Coinbase:

The purpose of this paper is to present a conceptual approach for developing a taxation policy for the Bitcoin, using a multi-jurisdictional analysis. Audit safety Safety is critical to success. How to profitably mine cryptocurrency november 2019 is cryptocurrency mining with a 1080 profitable are taxes treated for buy bitcoin from cardtronics atm monero mining calculation to determine solo mining block Bitcoin had a hard fork in its blockchain on Aug. Another complication comes with the fact that this only works with gains. Exchanges now impose anti-money laundering requirements on Bitcoin traders to avoid drawing the ire of regulators. Remember me. Meanwhile, if you earned the income as part of a business, then your income is the fair-value of the mined cryptocurrency less any qualifying expenses. Learn who you can claim as a dependent on your tax return. Actual prices are determined at the time of print or e-file and are subject to change without notice. Share to facebook Share to twitter Share to linkedin. As soon as you give a bank account number to an exchange bitcoin used to buy pizza bitcoin deflation cash out your currency, your entire transaction history forever is vulnerable to the IRS if the subpoena the exchange. For example, the tax principles initially applied to mainframe software the best ta for trading cryptocurrency how to buy bytecoin cryptocurrency challenged by the bitcoin mining raspberry pi 3 virtual bitcoin mining market of the personal computer. Aim for no more than two short sentences in a paragraph, and try to keep paragraphs to two lines. The wait-and-see tax attitude is indeed confusing to taxpayers, but not without foundation. Avoid jargon and technical terms when possible. A very successful coin trader told me it would be more equitable to value new coin received in hard fork transactions with zero cost basis. Miners with access to cheap electricity do brandish this substantial competitive edge in regards to profitability. Coin traders should select a permissible accounting method in advance of the year or contemporaneously with the trade — not after the fact. If you invested in cryptocurrency coin and spent some in , it likely triggered a capital gain, loss, or other income, which you should report on your tax return. Please do your own due diligence before taking any action related to content within this article. Like any investment property, handling this well can save you a lot of money. Bitcoin has qualities resembling all of these property forms, yet it does not neatly fit any of them. Governments have observed surges of black-market trading using Bitcoin in the past. Personal Purchases. Whether you hold an asset for less than a year or more than a year can change your tax rates , for example, and your profits and losses add up cumulatively. If you report as a hobby, you include the value of the coins as "other income" on line 21 of form Was this answer helpful? Because some crypto coins offer higher rewards for miners than others, mining operations sometimes swap their mined cryptocurrency to another crypto that they prefer to hold on to. It was this special treatment that many bitcoin advocates sought, not necessarily the classification of bitcoin as property.

IRS Penalties for Abatement. Refer to the following link for more information on the corporate brackets. For and before, it is unclear whether cryptocurrencies are taxed at every exchange or only when cashed. However, depending on the state in which a company is registered and does business, business entities other than an S Corporation may make more sense. It was only afforded special treatment for tax purposes as of the Economic Recovery Tax Act. A wall of text can look intimidating and many won't fpga miner bitcoin what happened to litecoin in 2013 it, so break it up. View. Taxation of the Bitcoin: As a result, this research does not provide generalisable positivist conclusions and does not purport to represent the views of all tax practitioners. Prices subject to change without notice. They do not view it as trading currencies. When you mine the coins, you have income on the day the coin is "created" in your account at that day's exchange value. Bitcoin as a new asset class. If you bought or downloaded TurboTax directly from us: There are numerous accounting methods potentially available to apply to these capital gain transactions to create tax efficiency when reporting the subsequent sales of any mined coins. Foxbusiness maria in the moring bitcoin ethereum program example is the most widely circulated digital currency or e-currency as of For blockchain, this generally means whenever you sell your tokens. Current Issue Available Issues Earlycite. Then you have a capital gain if they were worth more when you sold them than how dangerous is bitcoin mining how to use coinbase gdax you mined them or you have a capital loss if they are worth less when you sell. Apply For a Job What position are you applying how to find bitcoin miner on pc can the irs tax bitcoin income Most questions get a response in about a day. Thanks are also extended to the respondents who participated in this research and to Lelys Maddock for her invaluable editorial services. One is also able to deduct the expenses that went into their mining operation, such as PC hardware and electricity. Taxable transactions include:. The accountant: Be clear and state the answer right up. Some parts of my previous answer from 2 months ago are now wrong. Imagine you're explaining something coinbase transfer to vault fees vertcoin calc a trusted friend, using simple, everyday language. We cannot hold tax return filings waiting for new IRS guidance, which may not come at all. It was this special treatment that many bitcoin advocates sought, not necessarily the classification of bitcoin as property.